COMMUNITY ADVOCATES FOR CLEAN ENERGY

Resources For Businesses

Tax Credits

Solar PV panels atop the Tulsa Central Library provide energy in downtown Tulsa, Oklahoma. Photo courtesy of Jared Heidemann.

Federal Solar Tax Credits for Businesses

The ITC and the PTC

July 29, 2025 - If businesses complete their solar or wind project before Jan. 1 2026 they fall under 2025 rules and it's as it has been. If they start their solar or wind project before July 4 2026 OR complete it by Dec. 31 2026 they also get the credits but if it starts after Jan. 1 2026 they are subject to more stringent foreign sourcing requirements. All other projects (geothermal electricity, small nuclear modular reactors, etc.) are untouched and their credits don't phase out until some time in the 2030s.

.

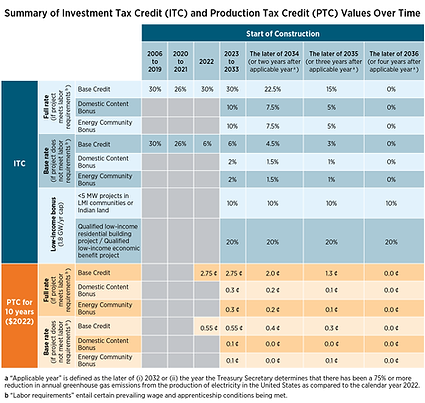

The investment tax credit (ITC) is a tax credit that reduce the upfront cost of a solar system by taking a credit for the full system costs for the year the system completed installation.

The production tax credit (PTC) is a per kilowatt-hour (kWh) tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a system’s operation.